The Minority in Parliament has urged Ghanaians to brace themselves to meet a severe hardship in the coming days.

According to them, the new implementation of Value Added Tax (VAT) on electricity will worsen the economic hardship in the country.

The Ministry of Finance in a statement said the implementation of VAT for residential customers of electricity above the maximum consumption level specified for block charges for lifeline units in line with Sections 35 and 37 and the First Schedule (9) of the Value Added Tax (VAT) Act, 2013 (ACT 870) has been scheduled for implementation, effective 1st January 2024.

“For the avoidance of doubt, VAT is still exempt for “a supply to a dwelling of electricity up to a maximum consumption level specified for block charges for lifeline units” in line with Sections 35 and 37 and the First Schedule (9) of Act 870.” The statement added.

“The Electricity Company of Ghana (ECG) and the Northern Electricity Distribution Company (NEDCO) are, hereby, requested to liaise with the Ghana Revenue Authority (GRA) to ensure that the implementation of VAT for residential customers of electricity above the maximum consumption level specified for block charges for lifeline units takes effect on Is January 2024, in line with Section 35 and 37 and the First Schedule (9) of Act 870,” Part of the statement read.

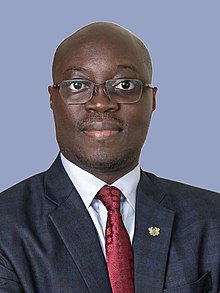

Reacting to the statement on X (formerly twitter), Minority Leader in parliament, Dr Cassiel Ato Forson stated that Ghanaians should brace up for more hardships from the government, which promised to reduce electricity tariffs but has ended up making us pay more for electricity.

He explained that “By the Finance Minister’s statement, this Akufo-Addo/ Bawumia government has increased electricity prices by 21.9% by introducing VAT on domestic consumption of electricity, which will include the following:

a. 15% VAT

b. 2.5% GetFund levy

c. 2.5% NHIL levy

d. 1% Covid levy

This VAT on domestic consumption of electricity is a final tax.

“Get ready to pay 21.9 % more on your electricity consumption in the middle of a new dumsor, which Dr Bawumia and the government have cowardly failed to admit.”

“Brace up for more hardships from the government, which promised to reduce electricity tariffs but has ended up making us pay more for electricity.” Ato Forson wrote.

“Since 2013, governments have refrained from imposing VAT on domestic consumption of electricity for very good reasons.

Such an implementation was going to increase the cost of electricity to domestic consumers without giving them the opportunity to reclaim their VAT (because domestic consumers of electricity are not VAT registered).” The former Minister of Finance added.

See the full statement by the Ministry of Finance below:

IMPLEMENTATION OF VALUE ADDED TAX (VAT) ON THE SUPPLY OF ELECTRICITY ABOVE THE LIFELINE FOR RESIDENTIAL PURPOSE

1. As part of the implementation of the Government’s Medium-Term Revenue Strategy and the IMF-Supported Post Covid-19 Programme for Economic Growth (PC-PEG). the implementation of VAT for residential customers of electricity above the maximum consumption level specified for block charges for lifeline units in line with Sections 35 and 37 and the First Schedule (9) of the Value Added Tax (VAT) Act, 2013 (ACT 870) has been scheduled for implementation, effective 1st January 2024.

2. For the avoidance of doubt, VAT is still exempt for “a supply to a dwelling of electricity up to a maximum consumption level specified for block charges for lifeline units” in line with Sections 35 and 37 and the First Schedule (9) of Act 870.

3. The Electricity Company of Ghana (ECG) and the Northern Electricity Distribution Company (NEDCO) are, hereby, requested to liaise with the Ghana Revenue Authority (GRA) to ensure that the implementation of VAT for residential customers of electricity above the maximum consumption level specified for block charges for lifeline units takes effect on Is January 2024, in line with Section 35 and 37 and the First Schedule (9) of Act 870,

4. By a copy of this letter GRA is requested to ensure that it liaises with ECG and NEDCO for the transfer of the revenues collected from the implementation of VAT on the subject matter as part of its domestic VAT collections.

5. We are counting on your usual cooperation in this regard.

Source: Elvisanokyenews.com