The Board Chair for Startup Cooperative Credit Union (STARTCCU) and law lecturer at GreenField College, Lawyer Samuel Mahmoud Fenbeti, says the Startup Cooperative Credit Union committed to supporting small scale businesses in Techiman, Bono East Region, and Ghana as whole.

According to him, a lot of informal and startup businesses lack access to credit to improve their business and as such lacks the environment to grow as a business.

Lawyer Fenbeti, attributed this to the policies and programs of financial institutions, which often overlook the needs of informal businesses.

The Law Lecturer, disclosed that the Startup Cooperative Credit Union, which is a subsidiary of Agrico Hub, aims to provide the needed support to the informal sector, by training these businesses on how best to improve the businesses while making funds accessible to startup businesses.

“This cooperative credit union came about because we realized that a lot of informal businesses which a high percentage of Ghanaians are involved in do not have access to credit in terms of improving their businesses.

“Our focus area as a hub is to promote youth employment, we realized that if you look at the cycle of help that can come for youth employment, we identify viable areas for people to go into business, we train them to undertake businesses, but there is no financial support, so we realized that in order to make our cycle of support to entrepreneurs in Ghana a effective, we don’t only need to train them in entrepreneurial opportunity but also give them opportunities where businesses are viable.

“It’s just like employment, when you go somewhere, they say, we are looking for somebody with 10 years experience or 3 years experience. The same way, when we are also training entrepreneurs to start businesses, they can’t access funding from the traditional banking sector so that is why we decided to start these Startup Cooperative Credit Union” He said

Lawyer Samuel Mahmoud Fenbeti, revealed that, the Startup Cooperative Credit Union, has a range of startup financial support for small scale businesses to benefit from. He however, encourage owners of small scale businesses to join the Startup Cooperative Credit Union as shareholders to better the chances of growing their businesses.

He said this during the first annual general meeting of the Startup Cooperative Credit Union. The Board Chair of the Startup Cooperative Credit Union expressed optimism of increasing their membership by 150% to 200% next year

“We have startup support financially that you can access but then you can also purchase minimum shares in the cooperative and then you will be saving with us. Through that we develop your financial base that you can always have access to funds to be able to grow your business.

“This year, we have canvas membership of about 1,000. Our target for next year is to hit 1,500 more or even 2,000 more so that by this time next year, we hope to have between 2,500 and 3,000 members for this cooperative union who are all small business owners benefiting from our training, our coaching, our information and access to funds through the credit union.” He explained.

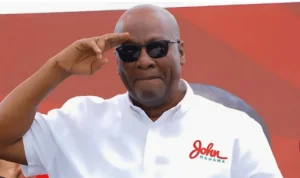

Mr. George Antwi Boasiako, CEO of Agricohub and Startup Cooperative Credit Union, encouraged young entrepreneurs to take advantage of the startup credit union’s financial assistance and support.

He said the Startup Cooperative Credit Union is poised to make a positive impact on the lives of many Ghanaian entrepreneurs.

“Our specialization is in business development, we are not just doing financial services, but we also ensure that we guide the businesses through the entrepreneurship journey.

“We respect the state of your business, we look at your business, we assess the business, and then we advise you and we handhold you so that you can actually grow the business.” He said

“Touching on some services the credit union provides, he said “We offer business advisory services, we offer financial management services, we also offer training.

“We train you as to how you will be able to put your business documentation together, records keeping, financial management and bookkeeping. These are all things that, ordinarily, most unions do not do, so you are helping the members to grow.” He told our reporter.

Mr. George continued “because we work with a business innovation hub, we actually take you through incubation and acceleration programs that will help you to be able to jump start and grow your business.”

Source: Elvisanokyenews.com